Review of the 2023-2024 Federal Budget

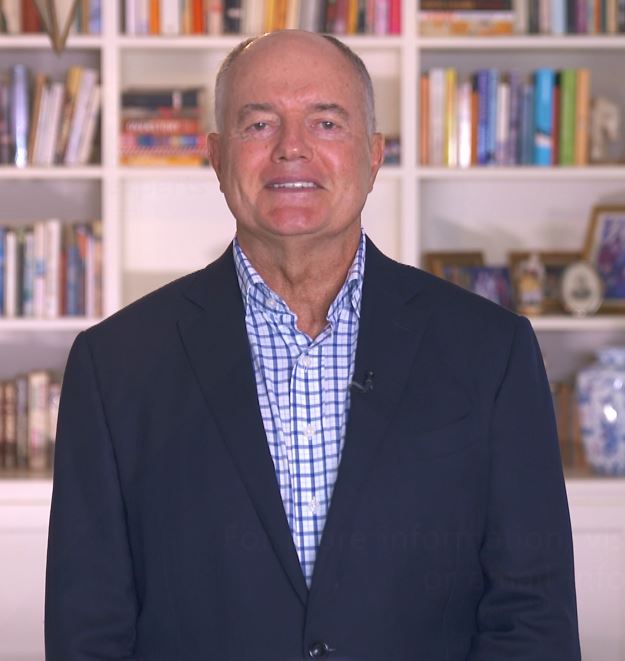

ACIS Founding Chairman Dr Ian Enright was asked by Insurance Business Australia to contribute his thoughts on the impact of the 2023-2024 Federal Budget on the insurance industry. The Insurance Business Australia article is available here. You can read Ian’s full article below.

Insurance Perspectives on the 2023-2024 Federal Budget

By Dr Ian Enright

The first real budget of this first-term government needed to balance dampening inflation against some relief for the cost-of-living crisis. Any temptation for structural change was likely removed by the size of the net government debt and the omnipresent fear of criticism for being poor money managers. It is a cautious budget and is attracting criticism for it. The difficulty noted by Rod Sims (in the context of the petroleum resource rent tax) is that: “If the government does not want to tax the high profits of the gas industry in a stronger way it will be hard to convince other sectors that they should pay more tax.”

There is little of direct relevance to insurance customers or the insurance sector, other than the macro factors in the economy that affect every industry and its customers.

There seems to be nothing, other than the cost-of-living measures ($14.6 billion), which would affect affordability and availability of insurance. Any impact will be minimal. The cost-of-living measures are focussed on reducing the costs of essential goods and services for those on lower incomes. The measures lower the poverty rate from around 13.6% to 13.3% of the population – lifting around 80,000 people out of poverty. Australian living standards measured by gross domestic product are set to go backwards in 2023–24 as total GDP grows by an unusually low 1.5% while Australia’s population grows by 1.7%, producing a so-called “per capita recession”.

The budget infrastructure program highlights port development, urban renewal and urban development. The program is dominated by funding for transport and for the Olympics and Paralympics. There is funding in the budget to improve emergency early warning systems. The Insurance Council of Australia (ICA) notes the budget’s commitment “to fund disaster resilience and measures to better protect Australian communities from extreme weather” and comments that: “insurance catastrophe claims costs from last year now hitting nearly $7 billion, much more will need to be done.” The ICA will continue to advocate for the funding to the Disaster Ready Fund (DRF) to be indexed and for it to run as a ten-year, rolling program. The Hazards Insurance Partnership informs future investments of the DRF and outlines a natural hazard risk database for Australia. It is necessary for these linked programs to be enhanced. There will be disappointment that the infrastructure program does not include more targeted infrastructure, capability or resilience to mitigate natural disasters.

There is some funding to help small business build resilience to cyber threats by undergoing Council of Small Business Organisations Australia (COSBOA) training for in-house cyber experts. This is a part of $101.6 million over five years from 2022–23 to support and uplift cyber security in Australia, including $19.5 million over the next 12 months to improve the security of critical infrastructure assets and help businesses respond to significant cyber attacks.

The tobacco excise is to be increased by 5% a year for three years which will brighten the outlook for the life insurance sector without having a substantial immediate impact on premiums or claims.

The ICA has welcomed the government’s commitment to introduce legislation to ensure tax law is aligned with accounting standards and minimise the regulatory burden on general insurers.

One omission from the current budget that must be addressed is the absence of proper provision for remediation of ACBF/Youpla losses. A comprehensive and long-term series of government and regulatory failures enabled the Aboriginal Community Benefit Fund (ACBF) later named Youpla to flourish by selling life insurance policies into remote First Nations communities for about 30 years. It was always a private business run for the profit of its shareholders and associated entities. Its flagrant illegalities were overlooked or ignored by Government, Treasury, the ATO, APRA, ASIC and Fair Trading regulators. On its collapse and voluntary liquidation in March 2022, an estimated 30,000 First Nations Australians lost an estimated $300 million in premium and claims. Another sequence of Government and regulatory failures means that the liquidation is unlikely to produce any material dividend for the First Nations policyholder creditors. The Australian Government committed interim emergency funding, limited to policyholders as at 1 April 2020, so that a small number of the bereaved could bury their dead. By March 2022 an estimated $1.4 million funding had been provided for 149 burials. The number now is 200 burials. The Government promised an enduring solution by November 2023 when the interim scheme terminates. The Strong Mob Debt Coalition, the peak voice to Government on the matter, notes that no provision for compensation or remediation has been made in the current Federal Budget.

Dr Ian Enright, ACIS Founding Chairman

ACIS Founding Chairman Dr Ian Enright is a company director, senior insurance executive, lawyer, academic and author who was an independent expert and insurance adviser to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. His book, Professional Indemnity Insurance Law, was described when he was awarded the British Insurance Law Association Book Prize as “the most notable contribution to literature in the field of law as it affects insurance”. Dr Enright and Professor Robert Merkin KC are the authors of Sutton on Insurance Law. He advises government, regulators and insurance industry bodies on regulation and policy matters.